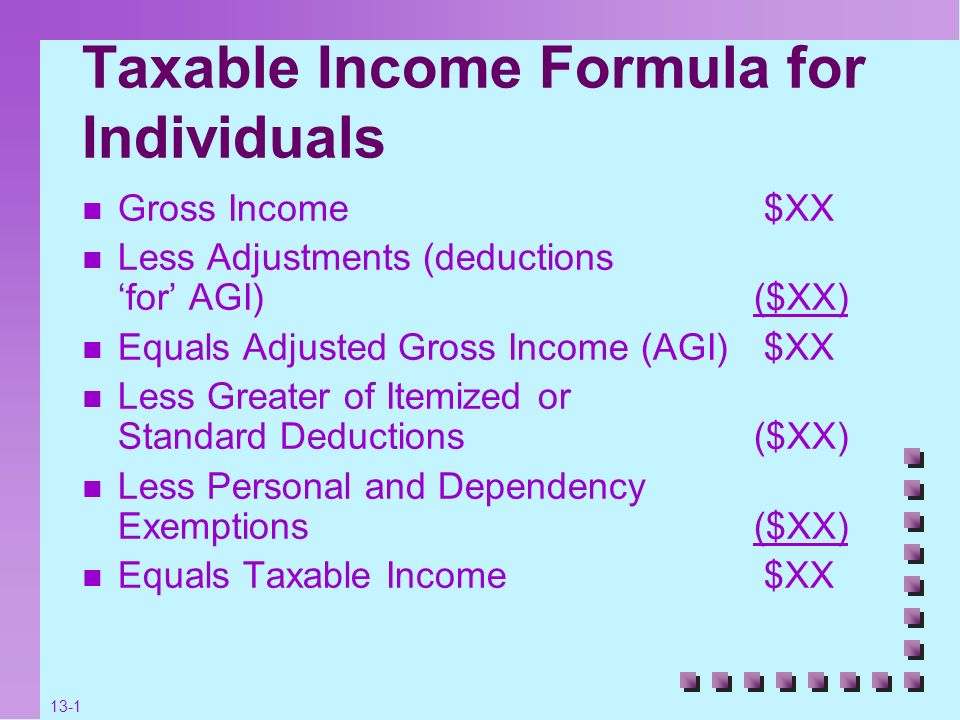

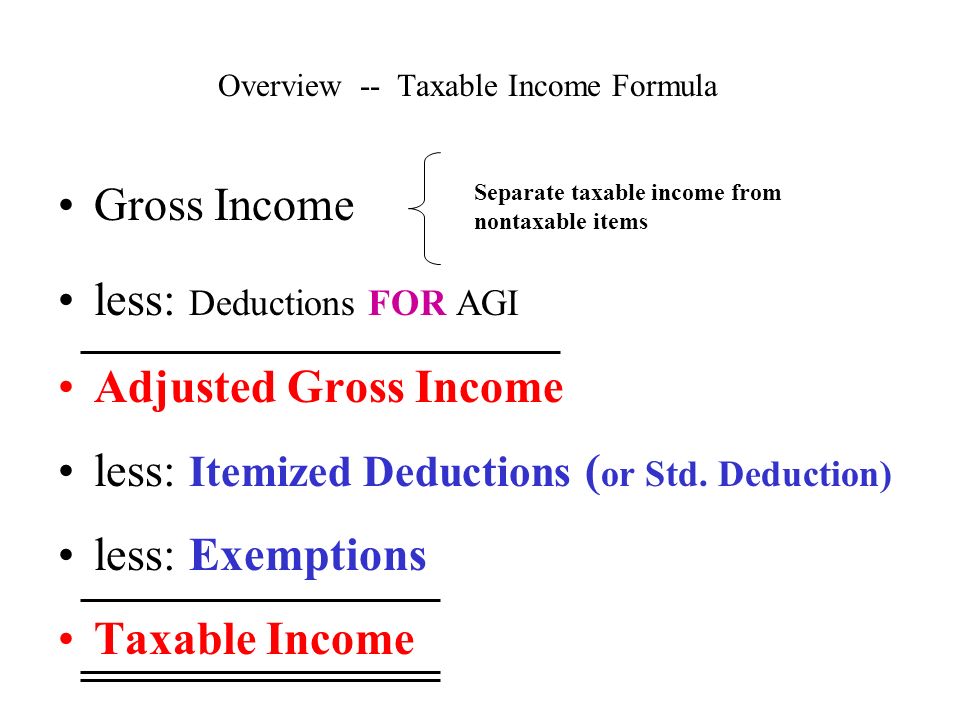

Taxable income formula

This list serves as a guide and is not intended to replace. Gross income is all income from all sources that isnt specifically tax-exempt under the Internal Revenue Code.

Taxable Income Formula Examples How To Calculate Taxable Income

Apply the following formula in cell B7.

. Thats because the IRS allows you to claim certain deductions that reduce your gross income to arrive at taxable income. Federal taxes State taxes Total Taxes 74K views How to Calculate Taxable Income The gross income is. You can calculate your taxable income in a few.

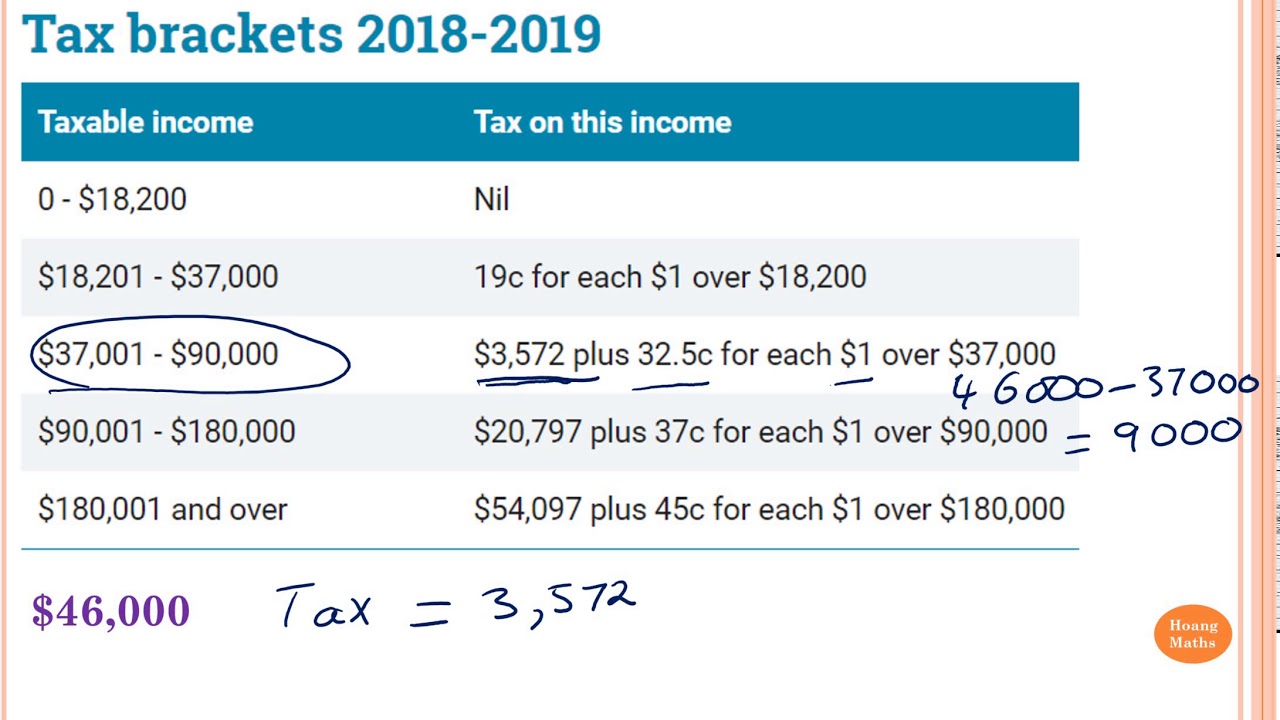

Now calculate the tax on extracted taxable value. Income tax is calculated for a business entity or individual over a particular period usually over the financial year. An amount of money set by the IRS that.

Gross Income x Tax Rate Taxable Income Calculating Taxes. As the taxable value is between 15 to 25 lakhs so that 5 will apply to income. This formula is simply the tax rate multiplied by the taxable income of the.

Taxable Income - With Calculation and Examples Provided All about Taxable Income in India. The tax payable will be thus 19950. Income includes your traditional salary and wages which are reported on form w-2 any earnings from self-employment ventures and any other income reported on 1099 forms.

Gross income is the amount of worldwide income that you earned during. Taxable income only represents the taxable portion of a companys profits. Divide the companys total tax liability by the statutory tax rate listed on the governments tax table to.

View a list of items included in Michigan taxable income. It is the gross income of an individual or company that is applicable for tax levy. Allowable deductions from gross income including certain employee personal retirement insurance and support expenses.

Employee compensation and benefits These are the most common types of taxable income and include. Therefore the taxable income becomes more than 57000 510006000 calculated with the same tax rate of 35. Taxable income starts with gross income then certain allowable.

Taxable income total income gross income - exempt income - allowable deductions taxable capital gains. Income Tax Payable for an. Taxable income is all income subject to Michigan individual income tax.

Social security benefits total 53125 and the taxable portion is 5574 10 Method 1 45156 53125 85 45156 Method 2 5574 Provisional Income PI. So to be sure about paying taxes heres a list of the types of income.

Taxable Income Formula Examples How To Calculate Taxable Income

Income Tax Formula Excel University

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula For Individuals Ppt Video Online Download

Calculating Tax Payable Part 1 Youtube

Taxable Income What Is Taxable Income Tax Foundation

Taxable Income Formula Examples How To Calculate Taxable Income

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Calculator Examples With Excel Template

Solved Which Of The Following Equations Represent The Chegg Com

California Tax Expenditure Proposals Income Tax Introduction

Chapter 3 Calculate Taxable Income Personal And Dependency Exemptions Ppt Video Online Download

Taxable Income Formula Calculator Examples With Excel Template